Pre-empting Risks- Learnings from investing in AstraZeneca Pharma

Early insights are extremely valuable in investing; both when buying and when exiting. In this blog I want to share how one can look for those early warnings through an example of AstraZeneca Pharma.

AstraZeneca Pharma India is an MNC that sells pharma products in India. The interesting part about the company is that its portfolio is majorly comprised of patented products with no competition.

Readers can access our full report on AstraZeneca Pharma here- https://www.surgecapital.in/sharedresearch

Though this patented product portfolio offers strong growth, it is also where the primary risk factor lies; if any of the major product loses patent, it would see sharp degrowth due to entry of generic competition and thus anyone invested in AstraZeneca needs to be aware of any impending patent risk.

I first came across AstraZeneca in April 2020 and invested in it given its strong business model (see report for details), high growth potential and high operating leverage in the business.

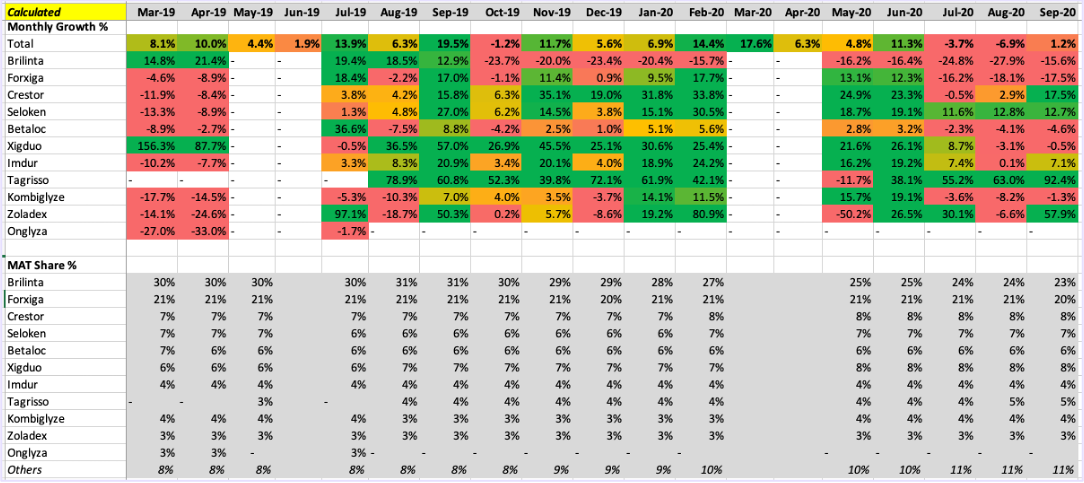

At the time of investing the only insight that I had was around the business model which I really liked and had no clue around its product portfolio and patent risk. Only after investing is when I started tracking monthly IPM data which indicated that company’s key product- Brilinta (~30% of revenues) has started degrowing due to entry of generics.

(I opened a demat account with Motilal just to get access to those monthly IPM reports :p)

However, overall the company was still growing at decent pace due to other newer products; but it was clear to me that I need to track IPM data closely to get a sense if any other product sees patent expiry because that will impact growth.

I quickly tried to figure out the patent risk for other larger products of the company and figured out that the 2nd largest product- Farxiga’s patent was to expire in Oct’20 and some companies like Natco Pharma had already launched an at risk generic in Apr’20 which was then challenged by AstraZeneca in court.

IPM data was still indicating double digit growth for Farxiga at that time, so I got on Natco’s earnings concall to figure out what was happening.

Snippets from Natco’s Q4FY20 concall held in Jun’20-

From the concall it was clear that Farxiga is bound to face generic competition and then July’20 IPM data also indicated a sharp degrowth in Farxiga sales indicating that AstraZeneca’s growth is bound to slowdown as two largest products contributing ~45% of the business will be degrowing for the foreseeable future.

IPM Data-

And thus, I exited my investment in AstraZeneca. The stock then went into correction for next ~2 years due to lack of growth.

The crux here is that being aware of the larger products, their patent status and confirming the same with other sources like IPM provided a solid early warning indicator in case of AstraZeneca way before actual results would reflect it.

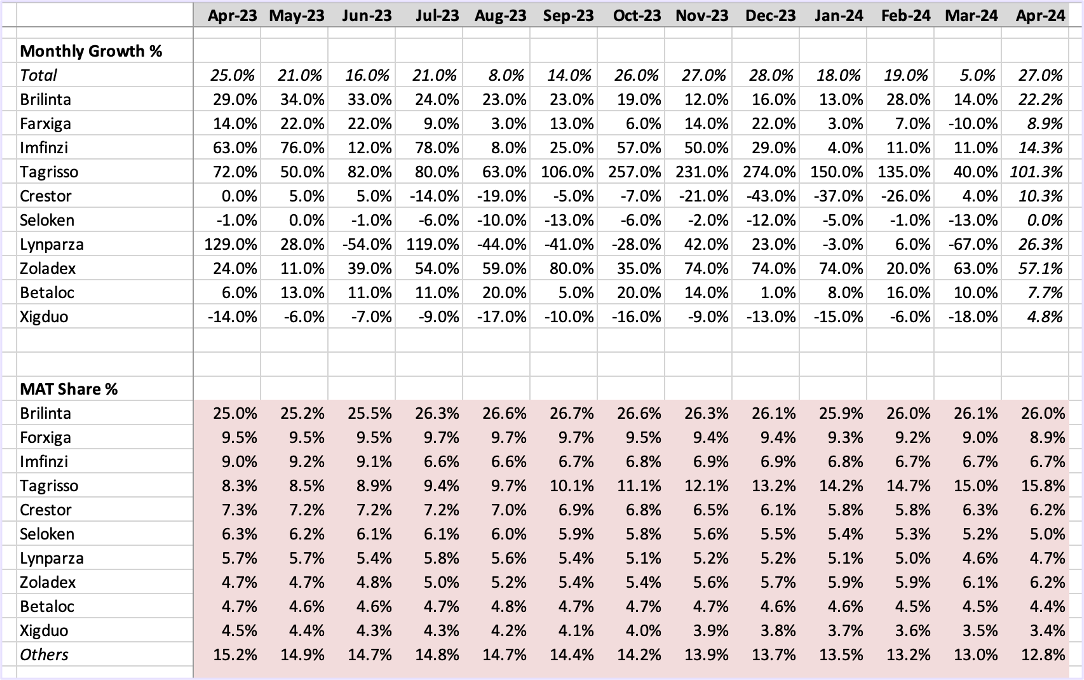

With this learning, I reinvested in AstraZeneca in Oct’23 as by then the generic competition on two earlier products have eased out and they were again growing, plus some new products like Imfinzi and Tagrisso were growing at extremely high rates; leading to 30%+ revenue growth for the company.

However, this time another risk played out which is that MNCs have the worst corporate governance. Though MNCs have some of the best businesses, they are extremely notorious when it comes to looking after the interests of minority shareholders.

As soon as an MNC business starts doing well, the parent entity starts working on how to extract more money from the Indian business. They do it either by creating a new private entity in India & divert the business or increase the royalty or change the transfer pricing.

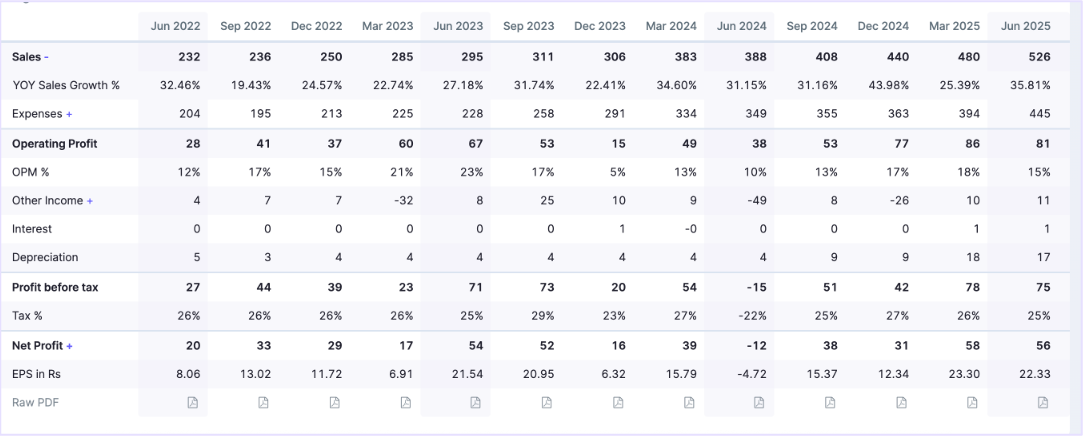

In case of AstraZeneca, they changed the transfer pricing agreement resulting in sharp reduction in gross margins and thus the whole PnL went for a toss. Despite continuously growing at 30%+ rates in revenues, the profits have degrown vs the expectations of profits growing at higher rates due to operating leverage.

The learning here is that if one is investing in an MNC company, be extremely cognizant of when the existing agreements are up for renewal and also be risk averse if the Indian entity starts to do very well. Because it is very likely that parent entity will try to extract more from the Indian entity and that is a risk that one needs to keep in mind when investing in MNCs.

In the end, I invested in AstraZeneca twice and both times learned something important. The 2nd time was a big bummer given that the business continues to grow ever so strong and thus should have been a big winner if not for change in transfer pricing.

Learnings from a 15x Investment 🔗

https://www.surgecapital.in/post/learnings-from-a-15x-investment