Simplest way to learn & grow as an investor is to have a strong feedback loop wherein you learn not only from your mistakes but also from success.

Successful investments not only reaffirms as to what works but there are also smaller lessons in form of mistakes because no successful investment is without its share of errors or challenges; it is extremely rare to have a successful investment wherein one gets all the aspects of buying, allocation, holding and selling perfectly right.

In this post I am going to talk about one of my most successful investments and all the learnings that came from it. The investment in discussion is Tips Music which has been ~15x investment over ~4-years.

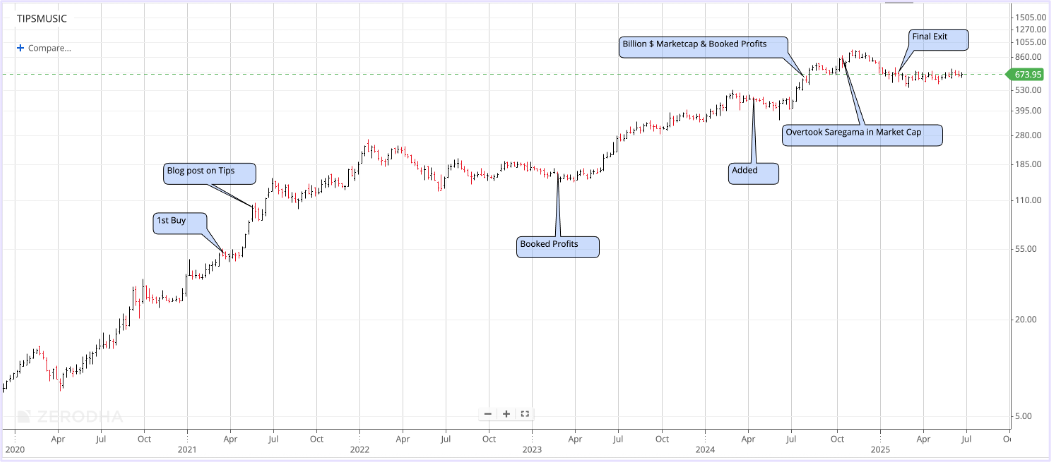

Following is the price chart of Tips overlayed with some of the key actions & events over the period of my holding;

I first bought Tips in Mar’21 when the company was ~Rs600 crores in market cap. My reasoning & thesis at that time was shared in a blog post in May’21; but the crux of what seemed to be working at that time & eventually worked for Tips was positive tailwinds in the industry and Tips’s strong positioning due to pure-play nature of the business.

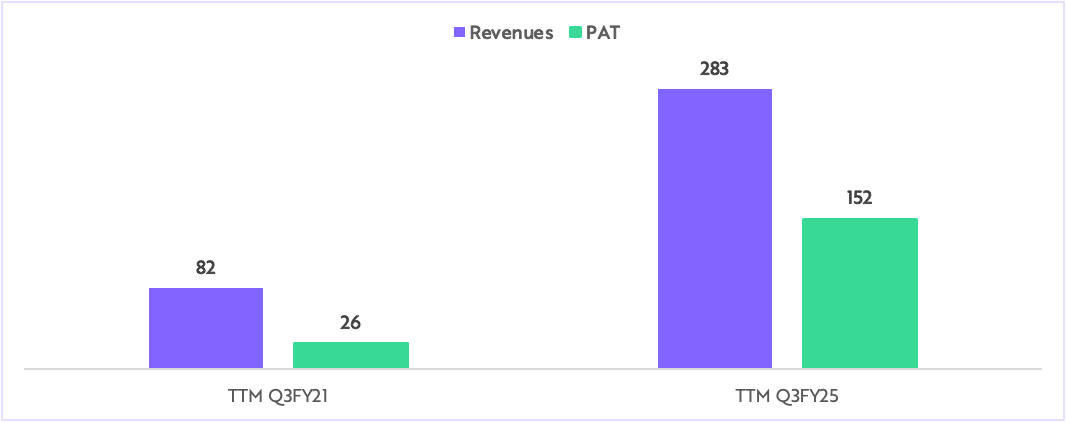

Tips has since reported 16 straight quarters of double-digit y-o-y revenue growth with a median revenue growth of ~30%;

Company’s TTM revenues and PAT grew by 3.5x and 6x respectively over the same period;

Because of this sustained quarter after quarter strong growth, the valuation multiples have also expanded from low 20s to >50x over this period;

So ~6x growth in net profits and ~2.5x increase in valuation multiple is how Tips became a 15 bagger.

There are two key learnings here;

It is extremely difficult to get 10 baggers or more without valuation re-rating. Even if a company grows its revenues & profits at strong double digit rates quarter after quarter, 10x growth in revenues & profits is a very long drawn journey. Valuation re-rating can shorten this journey in a big way.

But this journey has not been without its share of doubts and periods of underperformance. So, if one would see the initial chart; I had booked profits in Feb’23.

This happened because an investment that has been doing well will naturally become a much larger share of your portfolio by the time it is up say 3-5x; and a larger exposure naturally puts risk management of an investor into overdrive as even a small move in that particular stock moves your entire portfolio meaningfully. And thus, one becomes overly cautious and short sighted which is what happened with me.

The learning here is that it is extremely difficult to carry your entire initial investment over the years for that 10-15 bagger journey. Because things will not play out in a linear fashion, there will be periods of business underperformance or stock price underperformance or risk management which will make you trim.

But having said that, what is also true is that investing is about portfolio level returns and not how big you made in some individual outcomes. Rotating capital from existing bets to newer opportunities is always healthy for sustained compounding at a portfolio level.

Getting 2-3x outcomes on a recurring basis is relatively easier to do & would deliver much higher returns at a portfolio level vs trying to optimize for 10-15x outcomes which would be rare & difficult to get on a recurring basis.

2nd half of 2024 was eventful for Tips; firstly, the company crossed billion $ in market cap in July’24. In my May’21 blog post I had shared this-

Even though while writing that post I had a belief that Tips will become a billion $ company, I had never expected that it would happen so soon and that I would be an investor throughout this journey.

2nd thing that happened was, in Oct’24 Tips’s market cap crossed Saregama’s market cap. Many investors have a preference for larger companies in a peer group due to their perceived quality and low risk nature. And thus, larger peer typically trades at much higher valuations than smaller companies.

In case of Tips as well, most investors preferred Saregama and Tips was touted as low-quality name. However, with sustained & way better growth, Tips eventually received valuations suitable for its growth rate & ROCEs which are way higher than Saregama’s and thus Tips overtook Saregama in market cap despite being a smaller business.

Over the course of my investment in Tips, Saregama was up only ~3.5x vs ~15x for Tips.

The takeaway here is that this perceived quality & risk creates a favorable risk:reward in smaller companies which is what matters end of the day in investing. Plus, smaller companies because of their size have the potential to grow much faster than larger peers.

So, one should never ignore a smaller peer; if a smaller company continues to outgrow the larger peer, then the valuation difference will reduce and the end outcome will be much more superior than investing in the larger peer.

Tips vs Saregama is not an isolated case; I have seen this play out in two more investments- Safari and V2 Retail, wherein the smaller peer’s business outperformance is such that market starts valuing it at much higher multiples than the larger peer and thus the smaller peer overtakes the larger peer in terms of market cap.

To summarize the learnings & takeaways from this post;

Valuation re-rating is extremely important to get those 10 baggers or higher outcomes

Valuations will eventually reflect growth & ROCE; investors & market cannot ignore superior growth & ROCEs forever.

Every multibagger’s journey is full of challenges and it is very difficult to see through your entire initial investment through the journey.

2-3x outcomes on a recurring basis is relatively easier & far superior vs rare & difficult 10-15x outcomes.

Smaller peers might offer a much superior risk:reward than larger peers; do not fall for the perceived quality & risk.

Formula for 10x or more outcomes-